Returns of the Mint Tower Arbitrage Fund

The value of your investment can fluctuate. Returns achieved in the past do not offer guarantee for return in the future.

The value of your investment can fluctuate. Returns achieved in the past do not offer guarantee for return in the future.

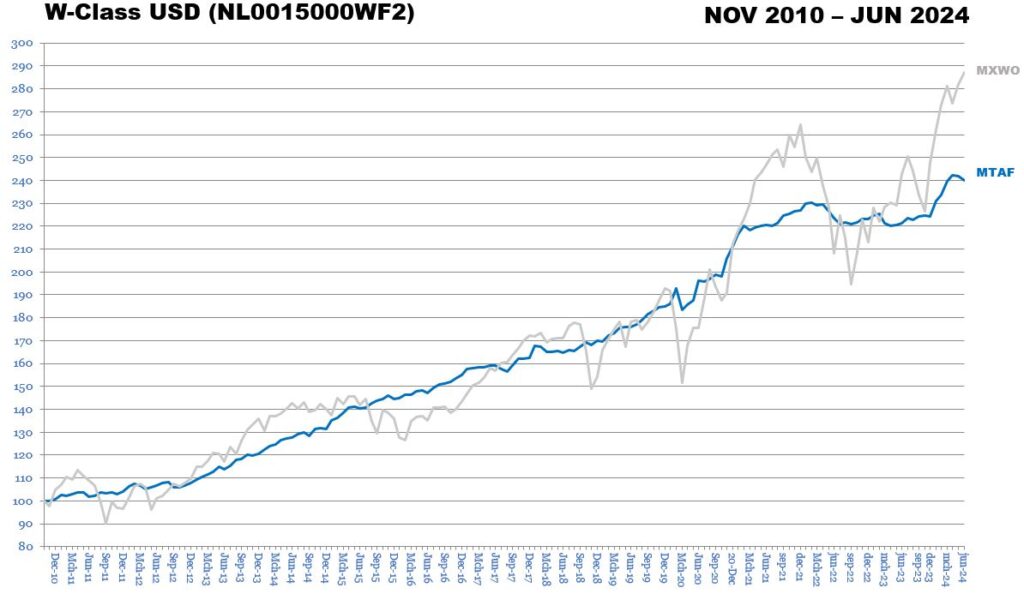

Since its founding in 2010, the Mint Tower Arbitrage Fund has achieved a positive return almost every year, thereby also successfully navigating the market turmoil in 2011, 2018 and 2020.

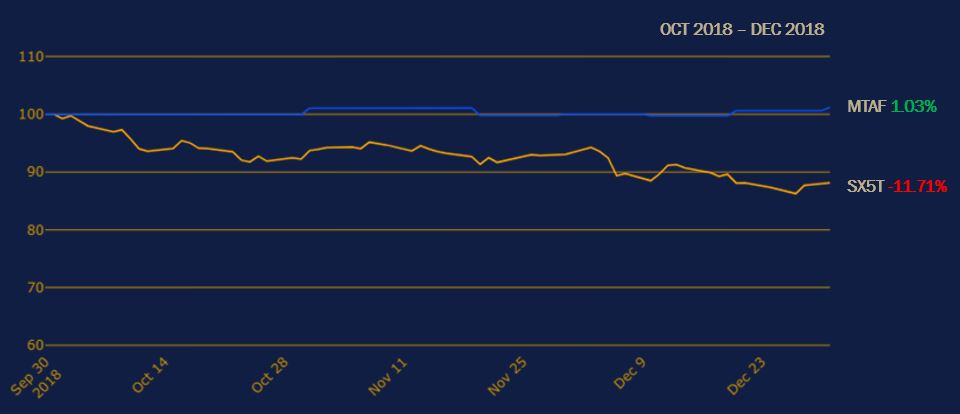

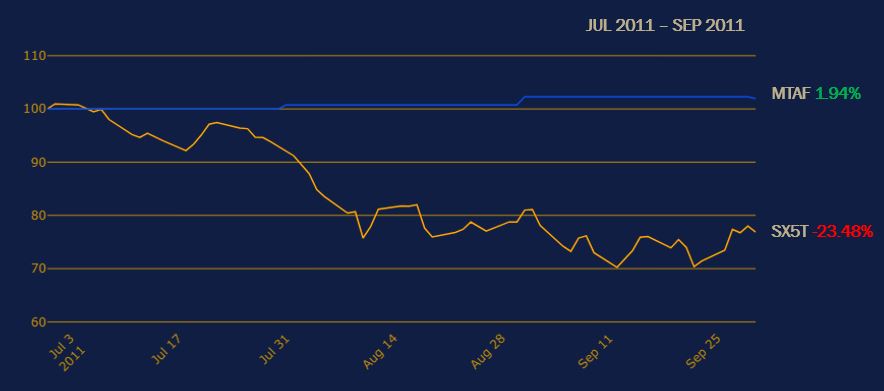

The fund’s objective is to achieve stable annual net returns of at least 5% on average over a 3-5 years horizon with emphasis on capital preservation under all market circumstances. This means that Mint Tower sets out to achieve such results independent of the directionality of the global financial markets. The graphs below highlight the market neutral behaviour of the fund.

The first graph shows the stable performance of the Mint Tower Arbitrage Fund (MTAF) compared to the MSCI World Index (MXWO). The other graphs zoom in on specific market events, thereby showing the clear diversification benefits provided by the fund.

Despite this stable return, the risk of losing the entire investment remains. Unlike a savings account, an investment in the fund is not guaranteed.

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

3.88%

3.48%

11.61%

8.87%

9.61%

6.31%

2.80%

2.56%

6.33%

12.61%

7.44%

-1.75%

1.68%

5.85%

The first quarter of 2020 was dominated by the COVID-19 pandemic. In February, volatility became considerably more expensive as equity markets fell. In contrast, other asset classes such as dividends and (convertible)bonds had not seen a significant correction yet. The stock market sell-off that had started in the last week of February culminated in a crash on Monday, 9 March, when stock markets fell by more than 7%. On 12 March, indices were down by almost 10% and further lows were made on 16 March (-13%). From the peak at the beginning of February to the lows in March, stock markets lost on average between 30% and 40%, thereby ending the years-long bull market. The Eurostoxx50 index lost approximately 29% the first quarter, while the Mint Tower Arbitrage Fund ended the quarter with -0.77%.

In October 2018, a confluence of factors (including the US-China trade war, Brexit, the Federal Reserve rate hike, declining growth rates in China) put the global economic growth expectations under pressure, thereby increasing the uncertainty in the financial markets. During the last quarter of the year, the Eurostoxx50 Index was down by almost 12%, while the MTAF gained 1%. This is a further manifestation of the fund’s limited correlation to the wider financial markets.

The European Debt Crisis of 2011 also cast a shadow on the stock markets. After a positive start for the year, the crisis escalated over the summer, leading to a sharp market sell-off. For example, the Eurostoxx50 Index fell by more than 23% during that period. With a return of +1.94%, the Mint Tower Arbitrage Fund showed the uncorrelated nature of its returns.

This is an advertisement. Please refer to the prospectus of the fund and key investor information document before making an investment decision. This will inform you, amongst other things, about the main risks associated with an investment in the fund.

Beursplein 5

1012 JW Amsterdam

The Netherlands

Tel. +31-(0)20-7977610

Mint Tower Capital Management BV heeft een vergunning als beheerder van een beleggingsinstelling (art. 2:65 Wet op het Financieel Toezicht) en staat als zodanig onder toezicht van de Autoriteit Financiële Markten (AFM) en De Nederlandsche Bank (DNB). Mint Tower Capital Management is opgenomen in het register van de AFM.

Mint Tower Capital Management BV has obtained a license as alternative investment fund manager (article 2:65 Financial Supervision Act). It is therefore regulated by the Authority for the Financial Markets (AFM) and the Dutch Central Bank (DNB). Mint Tower is included in the AFM register.